Thanks for all the birthday wishes. It's a lovely way to mark my special day. I haven't taken any new photos for this post, mainly b...

21 comments

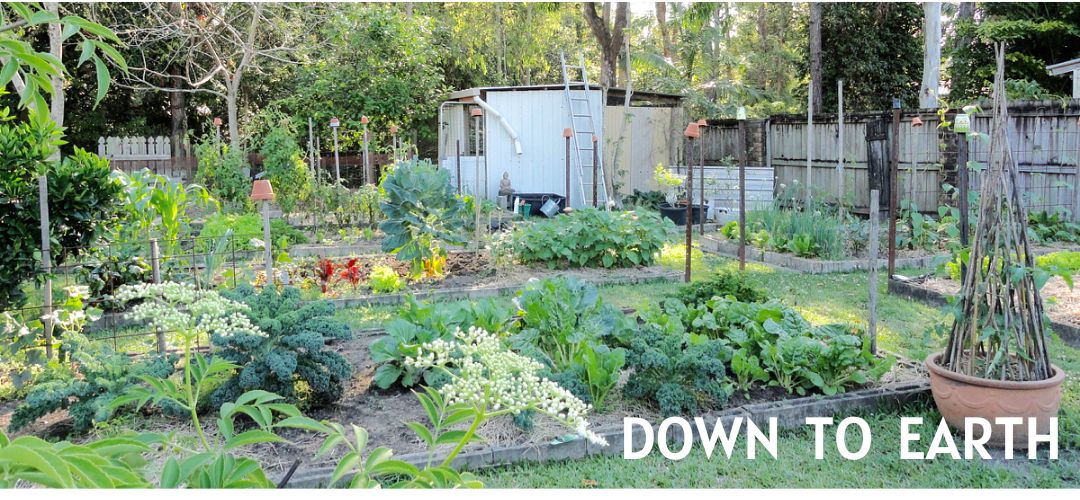

It's my birthday today, I'm 76. 🙂 I love being my age. Every stage of life brings new joys and challenges and now is no different....

I've been writing about change recently, mostly because I've undergone significant change in the last two years but also because tha...

One of the things I love about living alone is that I can do whatever I want to do. I've always been independent and a loner but this pu...

I gave up looking through supermarket specials catalogues years ago when I realised that 90 percent of what they reduced in price was junk f...

When I simplified my life I thought not much would change in the future. Looking back on it now, things didn't change for many years but...

When I started living a simpler life over 20 years ago, I saw it more as a collection of skills rather than a way of life. It took me a few ...

I used this quote at the beginning of chapter five in The Simple Home , Laundry Love. It's one of my favourites: “Without ambition one s...

Subscribe to:

Posts (Atom)